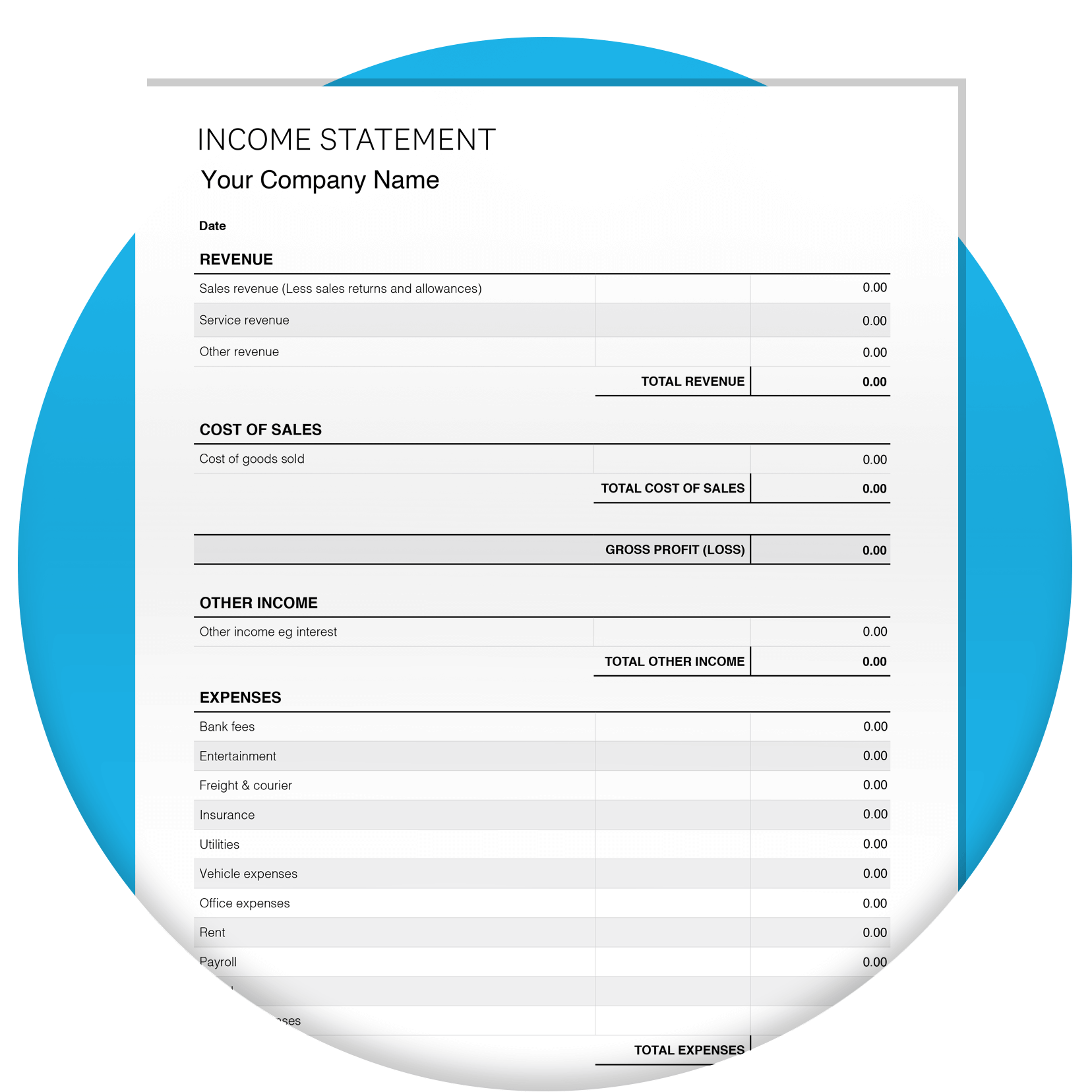

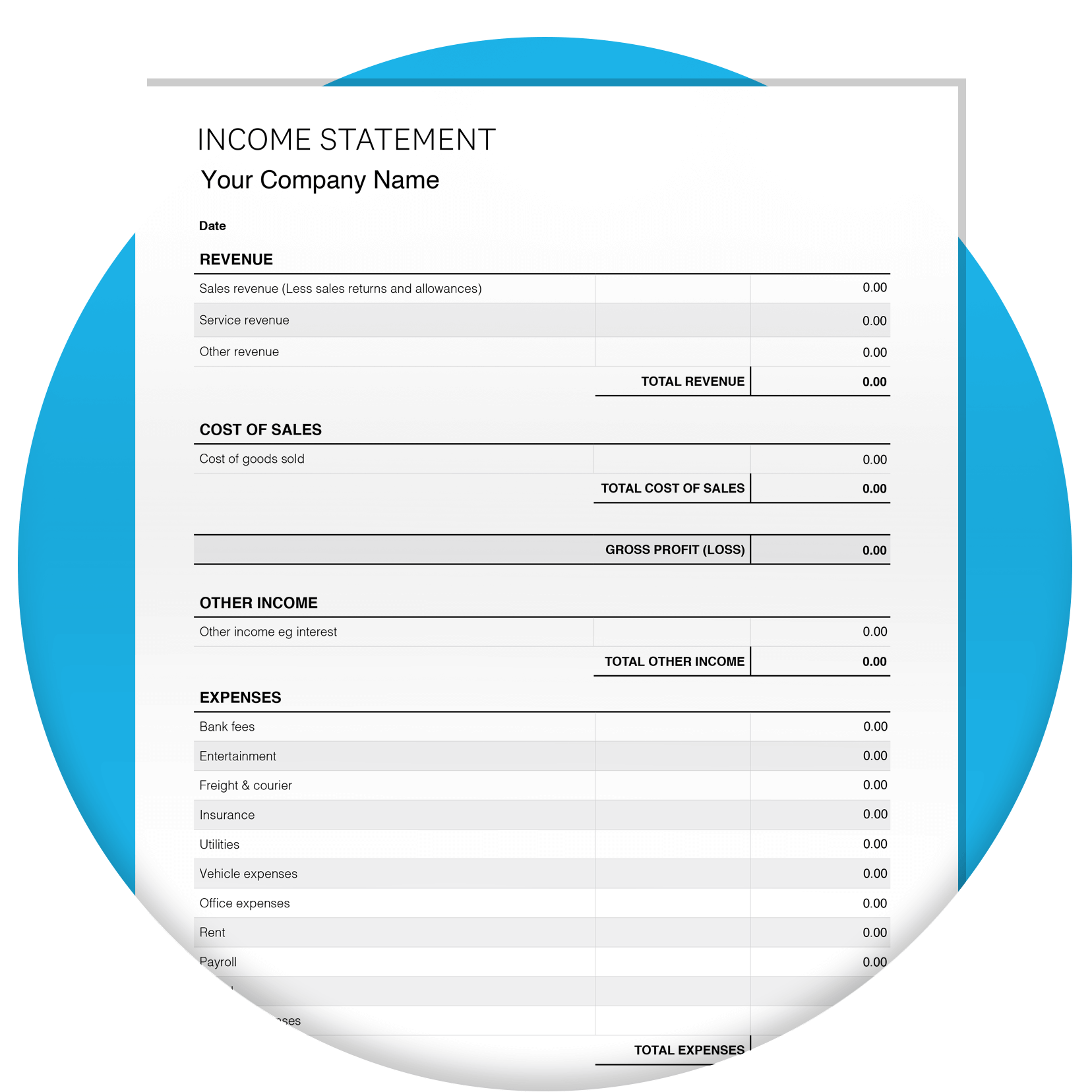

An income statement is a summary of your business income and expenses during a given time period. This free income statement template makes it easy to create an income statement for your business. Simply plug your numbers into the template and you're ready to go.

Record revenue, COGS and indirect expenses to calculate your net profit or loss before taxes.

Just put in your numbers and the calculations are done for you in an income statement format.

Reusable so you can compare with previous saved statements to see how your business is tracking.

Fill in the form to get an income statement template as an editable PDF. We’ll throw in a guide to help you use it.

An income statement is a financial report that shows a business's profits or losses over a set period of time. It summarizes the business's income and expenses, and typically shows profits both before and after taxes. Monthly, quarterly or yearly are the most common periods for a business to create an income statement.

An income statement is a financial report that shows a business's profits or losses over a set period of time. It summarizes the business's income and expenses, and typically shows profits both before and after taxes. Monthly, quarterly or yearly are the most common periods for a business to create an income statement.

What does income tax mean in your statement?An income statement often doesn’t report income tax. Instead, it reports profit or loss before tax. This profit or loss – which is on the last row of this free income statement template – is used to help calculate taxes. A business will generally be taxed on its profits. If you have an income statement that shows income taxes, that amount will then be subtracted to give a final figure that is net profit after tax.

An income statement often doesn’t report income tax. Instead, it reports profit or loss before tax. This profit or loss – which is on the last row of this free income statement template – is used to help calculate taxes. A business will generally be taxed on its profits. If you have an income statement that shows income taxes, that amount will then be subtracted to give a final figure that is net profit after tax.

What is the most important part of an income statement?The most important part of an income statement is the bottom line. It shows how much your business earned or lost during the time period used. If you have a profit, your business strategy is working. If you have a loss, you may need to take a closer look to see where the problem lies. Pay attention to your revenue, cost of goods sold, operating expenses, and taxes as they directly affect your bottom line and should be considered when planning your budget or making investments.

The most important part of an income statement is the bottom line. It shows how much your business earned or lost during the time period used. If you have a profit, your business strategy is working. If you have a loss, you may need to take a closer look to see where the problem lies. Pay attention to your revenue, cost of goods sold, operating expenses, and taxes as they directly affect your bottom line and should be considered when planning your budget or making investments.

Can I use Excel or Google Sheets to make an income statement template?Yes, you can make an income statement with Excel or Google Sheets, but our simple income statement template is easier to complete and can be used over and over again. An even easier option is to use accounting software to generate your financial reports. With cloud-based software, you can access accurate, up-to-date numbers and financial reports from anywhere.

Yes, you can make an income statement with Excel or Google Sheets, but our simple income statement template is easier to complete and can be used over and over again. An even easier option is to use accounting software to generate your financial reports. With cloud-based software, you can access accurate, up-to-date numbers and financial reports from anywhere.